All Categories

Featured

Table of Contents

They typically offer an amount of coverage for much less than permanent kinds of life insurance policy. Like any type of plan, term life insurance coverage has benefits and drawbacks depending on what will function best for you. The benefits of term life include cost and the capacity to tailor your term size and coverage amount based upon your needs.

Relying on the type of plan, term life can offer fixed premiums for the entire term or life insurance on degree terms. The death advantages can be fixed. Due to the fact that it's a budget-friendly life insurance policy item and the settlements can stay the same, term life insurance policy plans are preferred with young individuals simply starting, households and individuals that desire security for a details amount of time.

Flexible What Is Decreasing Term Life Insurance

You should consult your tax experts for your certain accurate scenario. Fees mirror plans in the Preferred Plus Rate Class concerns by American General 5 Stars My representative was really educated and useful at the same time. No stress to purchase and the procedure fasted. July 13, 2023 5 Stars I was pleased that all my needs were fulfilled immediately and properly by all the agents I spoke to.

All documents was digitally finished with accessibility to downloading and install for personal data maintenance. June 19, 2023 The endorsements/testimonials presented should not be taken as a referral to purchase, or an indicator of the worth of any kind of item or solution. The testimonies are real Corebridge Direct clients that are not associated with Corebridge Direct and were not offered payment.

1 Life Insurance Policy Data, Information And Market Trends 2024. 2 Cost of insurance policy rates are established utilizing methodologies that vary by company. These prices can differ and will typically boost with age. Rates for energetic workers may be various than those readily available to terminated or retired staff members. It's essential to look at all elements when assessing the overall competitiveness of rates and the worth of life insurance policy coverage.

Term Life Insurance For Couples

Like many team insurance coverage policies, insurance policy plans provided by MetLife contain specific exclusions, exemptions, waiting periods, reductions, restrictions and terms for maintaining them in pressure (what is level term life insurance). Please contact your benefits administrator or MetLife for prices and full information.

Essentially, there are 2 kinds of life insurance coverage plans - either term or long-term plans or some mix of both. Life insurance companies offer different forms of term strategies and conventional life plans as well as "passion sensitive" products which have come to be extra common since the 1980's.

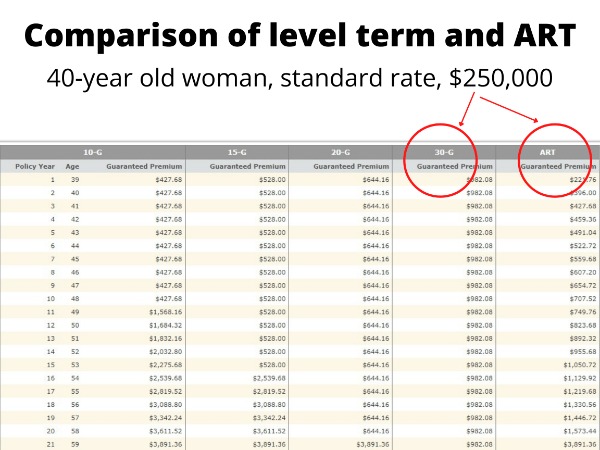

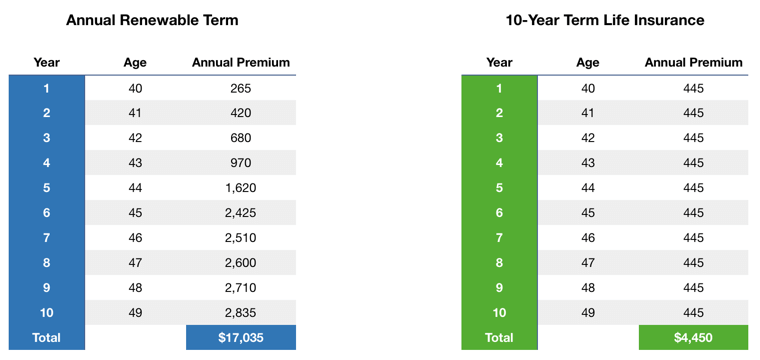

Term insurance policy offers security for a specified amount of time. This duration could be as brief as one year or supply protection for a details number of years such as 5, 10, 20 years or to a specified age such as 80 or in some cases up to the oldest age in the life insurance policy death tables.

Cost-Effective Direct Term Life Insurance Meaning

Presently term insurance prices are really competitive and among the least expensive traditionally skilled. It must be noted that it is an extensively held belief that term insurance is the least expensive pure life insurance policy protection available. One needs to evaluate the policy terms very carefully to choose which term life alternatives are suitable to meet your certain situations.

With each new term the costs is increased. The right to restore the plan without proof of insurability is an important advantage to you. Otherwise, the risk you take is that your health and wellness might degrade and you may be unable to obtain a policy at the same rates or perhaps in all, leaving you and your recipients without insurance coverage.

The length of the conversion period will vary depending on the kind of term plan purchased. The costs price you pay on conversion is generally based on your "present acquired age", which is your age on the conversion day.

Under a degree term plan the face amount of the policy continues to be the exact same for the whole period. Commonly such policies are offered as home loan security with the amount of insurance policy reducing as the equilibrium of the home loan lowers.

Generally, insurance firms have not had the right to transform costs after the plan is marketed (decreasing term life insurance). Considering that such plans might continue for years, insurance companies have to make use of conservative death, interest and expense rate estimates in the costs computation. Adjustable costs insurance policy, however, enables insurance companies to offer insurance policy at lower "existing" premiums based upon less traditional presumptions with the right to change these costs in the future

Dependable Term To 100 Life Insurance

While term insurance is made to provide defense for a defined time period, permanent insurance policy is created to give insurance coverage for your whole life time. To keep the costs price level, the premium at the younger ages surpasses the real cost of defense. This additional premium develops a get (cash value) which aids spend for the plan in later years as the price of security increases above the premium.

The insurance policy firm spends the excess costs bucks This kind of policy, which is sometimes called cash money value life insurance, produces a cost savings aspect. Money worths are vital to an irreversible life insurance coverage policy.

Term 100 Life Insurance

Occasionally, there is no relationship between the size of the cash worth and the premiums paid. It is the cash worth of the policy that can be accessed while the policyholder lives. The Commissioners 1980 Criterion Ordinary Mortality (CSO) is the existing table utilized in calculating minimal nonforfeiture values and plan reserves for average life insurance coverage policies.

Several permanent plans will certainly have stipulations, which define these tax requirements. There are 2 standard groups of irreversible insurance policy, standard and interest-sensitive, each with a number of variants. Additionally, each group is typically readily available in either fixed-dollar or variable form. Traditional whole life plans are based upon lasting estimates of expenditure, rate of interest and mortality.

If these price quotes change in later years, the firm will certainly change the premium as necessary however never ever over the maximum assured costs specified in the plan. An economatic entire life plan offers a fundamental quantity of participating whole life insurance coverage with an additional supplemental coverage provided with the usage of rewards.

Due to the fact that the costs are paid over a shorter period of time, the costs repayments will be higher than under the entire life strategy. Single costs entire life is minimal repayment life where one huge premium repayment is made. The plan is fully paid up and no additional costs are needed.

Latest Posts

Funeral Insurance Brokers

1 Life Direct Funeral Cover

Fidelity Final Expense Insurance